If you prepare account reconciliations, you are researching documents such as bank statements, invoices, or contracts to substantiate your account balances. But how do you share those documents as support for your reconciliations? And where do you save the supporting documents, so you don’t have to look for them again next month?

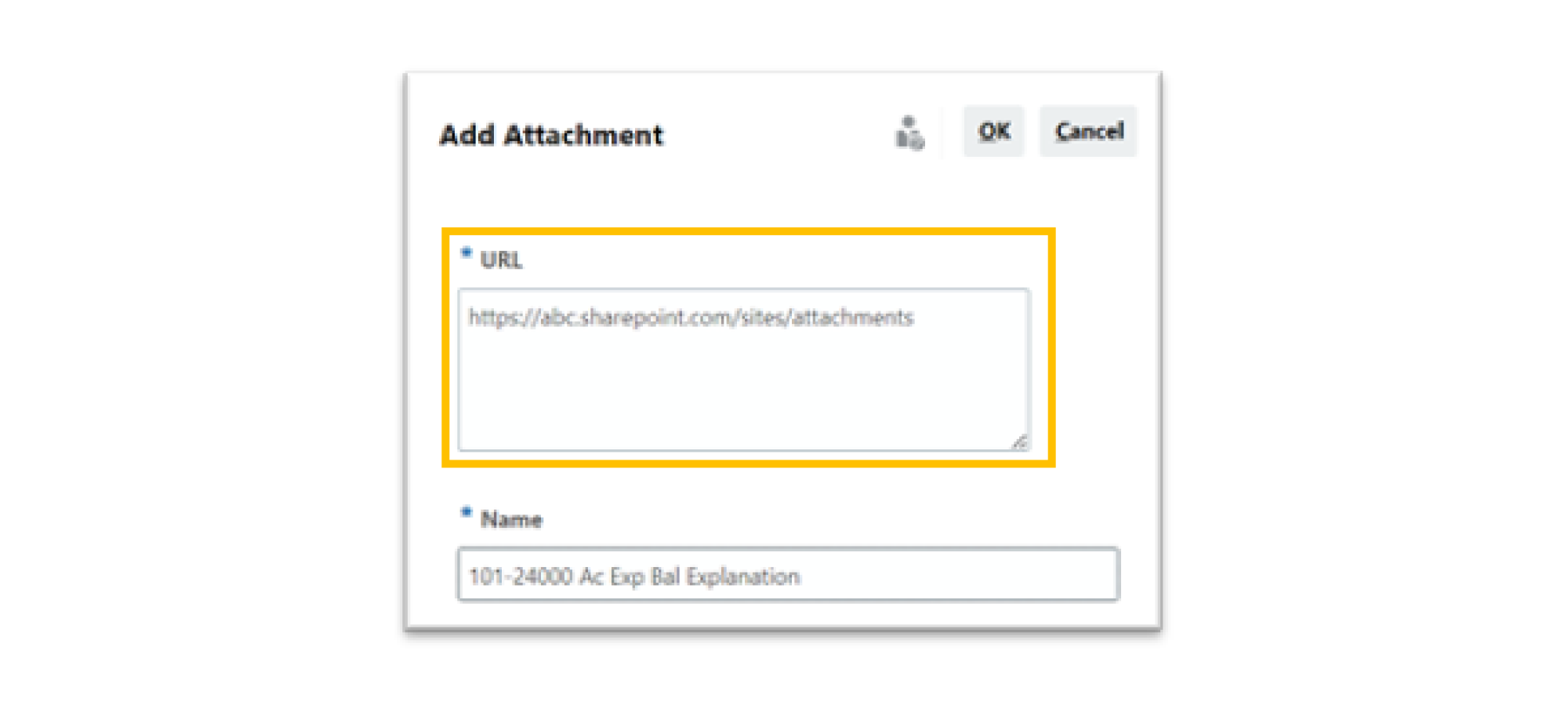

With Oracle Account Reconciliation, you can add your documentation directly to your reconciliation as an attachment or via a URL link to a document sharing site (e.g., Box or SharePoint). Before we dive into how to use attachments effectively in the platform, let’s talk briefly about Oracle’s Account Reconciliation solution.

About Oracle Account Reconciliation

Oracle Account Reconciliation is a powerful solution within the EPM Cloud Suite designed to automate and streamline the reconciliation process. It includes two modules: Reconciliation Compliance and Transaction Matching. Reconciliation Compliance helps you manage recurring account reconciliation processes while Transaction Matching provides functionality for automating high-volume, labor-intensive reconciliations.

Managing attachments for streamlined account reconciliation

Original contracts, invoices, or other source documents can be saved and attached, eliminating the need for future research on the same item. For example, a bank statement for an employee loan can be attached as proof of the original transaction.

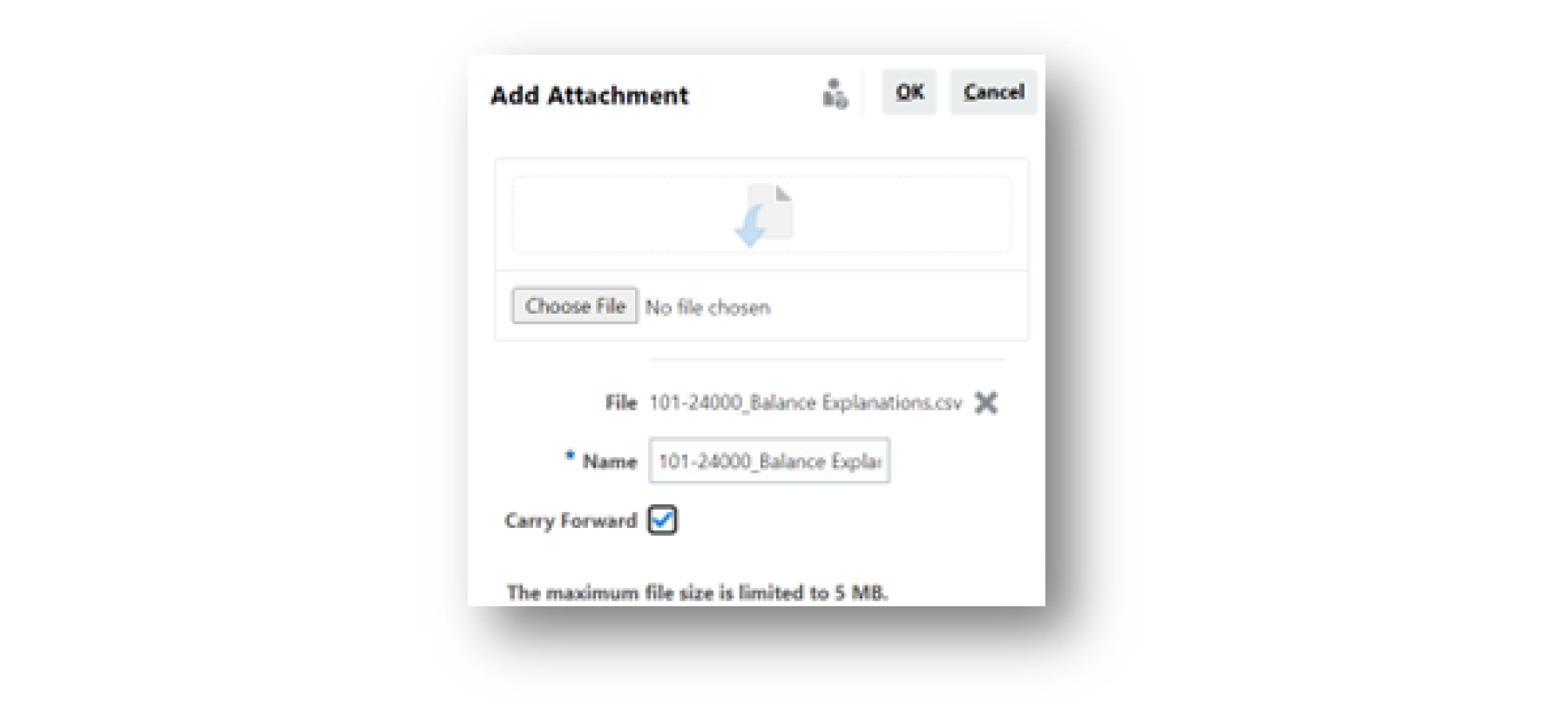

Adding an attachment requires only a few steps. First locate your support, download it, and save it to your computer or to a shared location, then attach it to your reconciliation.

Where to place attachments in Oracle Account Reconciliation

You can add attachments to the overall reconciliation or to the transactions you have added to explain a balance. You don’t have to select one method or the other, you can do a combination of both. The choice depends on the type of account and its content.

Adding attachments to the overall reconciliation

If you have one document that explains and supports 100% of the account balance, you can add it one time to the overall reconciliation. This works well if the account contains one item, such as a bank loan or prepaid rent.

As you might guess, this approach does not work as well if you have multiple line items or transactions which make up the balance in your account. Also, all the supporting documentation will appear in a list on the reconciliation page, with no indication of which attachment or URL link supports which transaction.

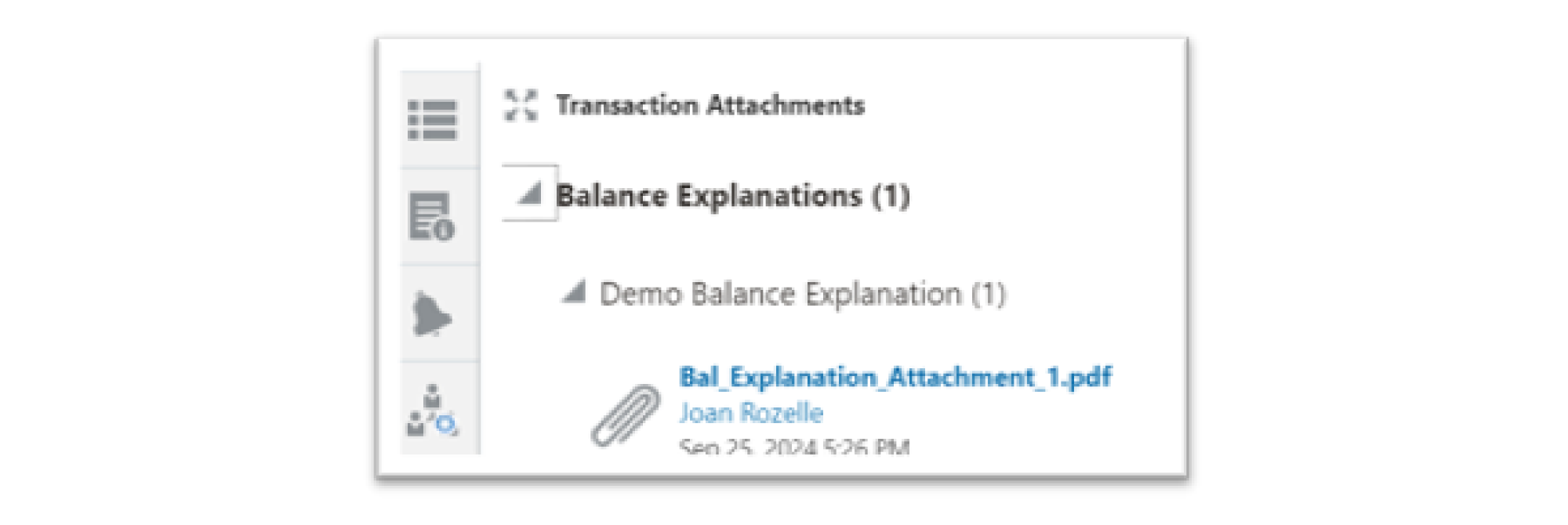

Adding attachments to individual transactions

Each line item is supported and documented. Because you are adding a document to support that particular transaction, the reviewer does not have to search all attachments to find support for the item.

If you are adding an attachment to each transaction in the reconciliation, you may be adding a lot of files to your reconciliation, with potential duplicates. A policy about limiting attachments may help mitigate these issues but won’t prevent it from happening.

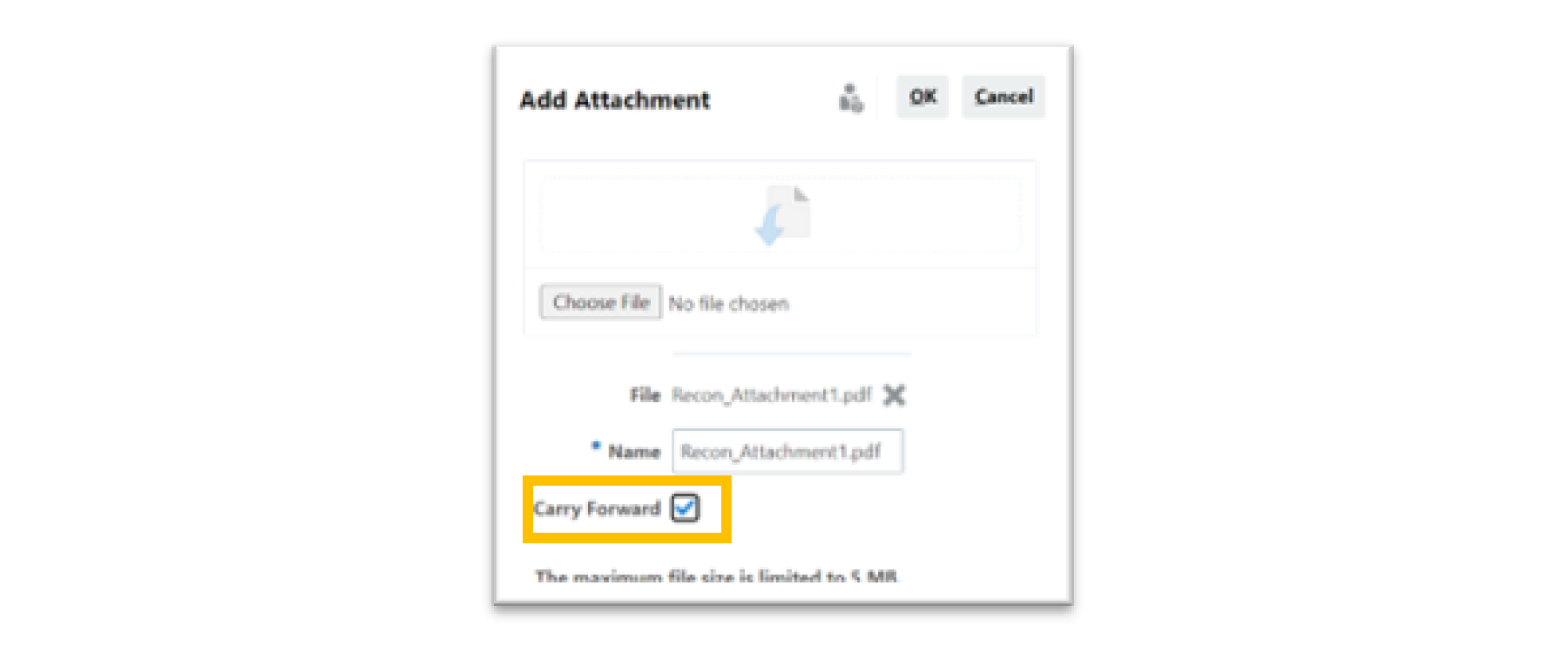

Carryforward attachments for future periods

You can carry forward the attachments to the next period. Rules can be added to your format to initiate the process automatically, or it can be done manually by checking a carryforward box before saving the attachment.

If a Balance Explanation is carried forward as an attachment from period to period, it improves preparer/reviewer efficiency. Explanations are at hand and don’t have to be reinvestigated.

How to mitigate storage issues resulting from too many attachments

Most client storage is taken up by reconciliation and comment attachments. Too many carryforward attachments can cause performance issues in the Account Reconciliation application. To remediate the storage issue, preparers should be judicious about what they attach, including the size of the document. Balance explanation/adjustment carryforwards should be stopped when they cease being relevant to the account balance. They will remain with any prior period reconciliations in the reconciliation history.

Resolving storage capacity by using URL links instead of attachments

Adding a link is quicker and easier than uploading a file attachment and drastically cuts down on storage space. If you use a collaboration tool such as Confluence, Slack or SharePoint, for example, you can create an in-house filing system for all your reconciliation attachments.

A downside to this approach, however, is that shared files can be moved or deleted, thereby breaking the link to your reconciliation. Further work is then required to locate and restore your files and your link.

Optimizing storage and performance with Oracle Cloud Infrastructure (OCI) Object Storage

The best practice for storing attachments is to use OCI Object Storage to eliminate the performance and storage issues caused by a large account reconciliation database. Object storage is a separate cloud storage solution used for unstructured data such as text, documents, or images. Account Reconciliation moves attachments to reconciliations, transactions, and alerts to and from OCI Object Storage. OCI Object Storage allows for a significant reduction in the size of a snapshot, so the subsequent backup, download and restore steps are quicker.

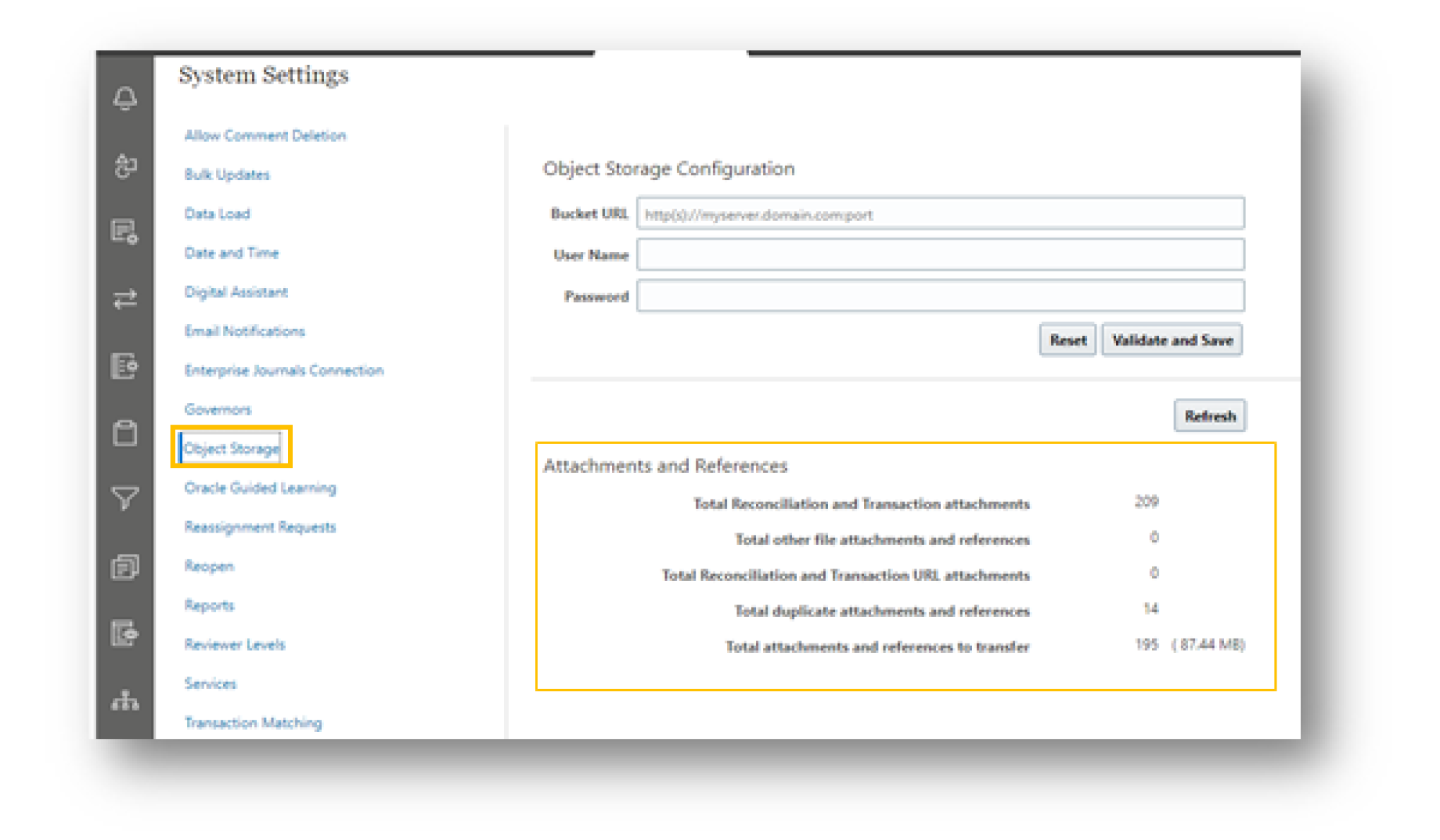

An additional space saver is if the same attachment is used to support more than one reconciliation, it will be identified as a duplicate and only stored once. As you can see in the example below, the total Reconciliation and Transaction attachments in Object Storage are 209 but 14 are listed as duplicates. Total attachments and references to transfer will be 195 with a storage size of 87.44 MB.

OCI Object Storage requires its own subscription and configuration, but after it is set up the attachments will be saved there going forward. Once you start using OCI Object Storage, you cannot go back to using the Account Reconciliation database for these attachments. Another key step to note: you will no longer delete attachment files in Account Reconciliation. Instead, you will delete them in conjunction with your retention policy in OCI Object Storage. Your retention policy can have a time stamp which is based on a “last modified” date. Retention rules are configured at the bucket level and are applied to all individual objects in the bucket. For example, if your retention policy is one year, this policy applies to the bucket and all attachments in that bucket. You cannot delete the attachment until 12 months after any item was last modified. For these reasons, you should put careful consideration into your retention policy prior to implementation of OCI Object Storage. Good planning and communication will help to set up a strong policy that works for your team.

Streamlining attachments and workflows with Oracle Account Reconciliation

With Oracle Account Reconciliation, you will streamline your monthly reconciliation process, improve workflow efficiency, and ensure regulatory compliance through well-documented results. As reconciliation automation becomes routine, managing attachments seamlessly integrates into your financial workflows. By utilizing cloud integration with OCI Object Storage, your organization can significantly optimize business processes, reduce storage costs, and improve overall application performance.

OCI Object Storage is particularly beneficial for business process optimization, allowing you to store and retrieve attachments with minimal disruption to your reconciliation operations. This ensures that all documents, such as bank statements, invoices, and contracts, are efficiently linked to specific transactions, further enhancing the accuracy and speed of the reconciliation process. By automating and optimizing attachment management, your organization can stay ahead in the competitive financial landscape while ensuring compliance with evolving regulatory standards.

As a trusted Oracle partner, Alithya is here to guide your organization through the transition to Oracle solutions, helping you optimize your workflows and achieve greater business success. Contact us to learn more about how Alithya can support your digital transformation journey.