In our last blog we started our journey of solutioning Operational Transfer Pricing (OTP) in the cloud with the basics of why OTP is necessary and how it should be implemented. We shared some common challenges and introduced a framework to successfully implement OTP as a cloud solution.

This post introduces the most essential application technology in our solution stack, Oracle Profitability and Cost Management Cloud Service (PCMCS), that will be utilized as our core calculation engine and reporting tool. After our (very) brief introduction to PCMCS, we will explore the high expectations of our OTP application, explore some of the most common OTP methodologies that are deployed, and set the stage for building our application.

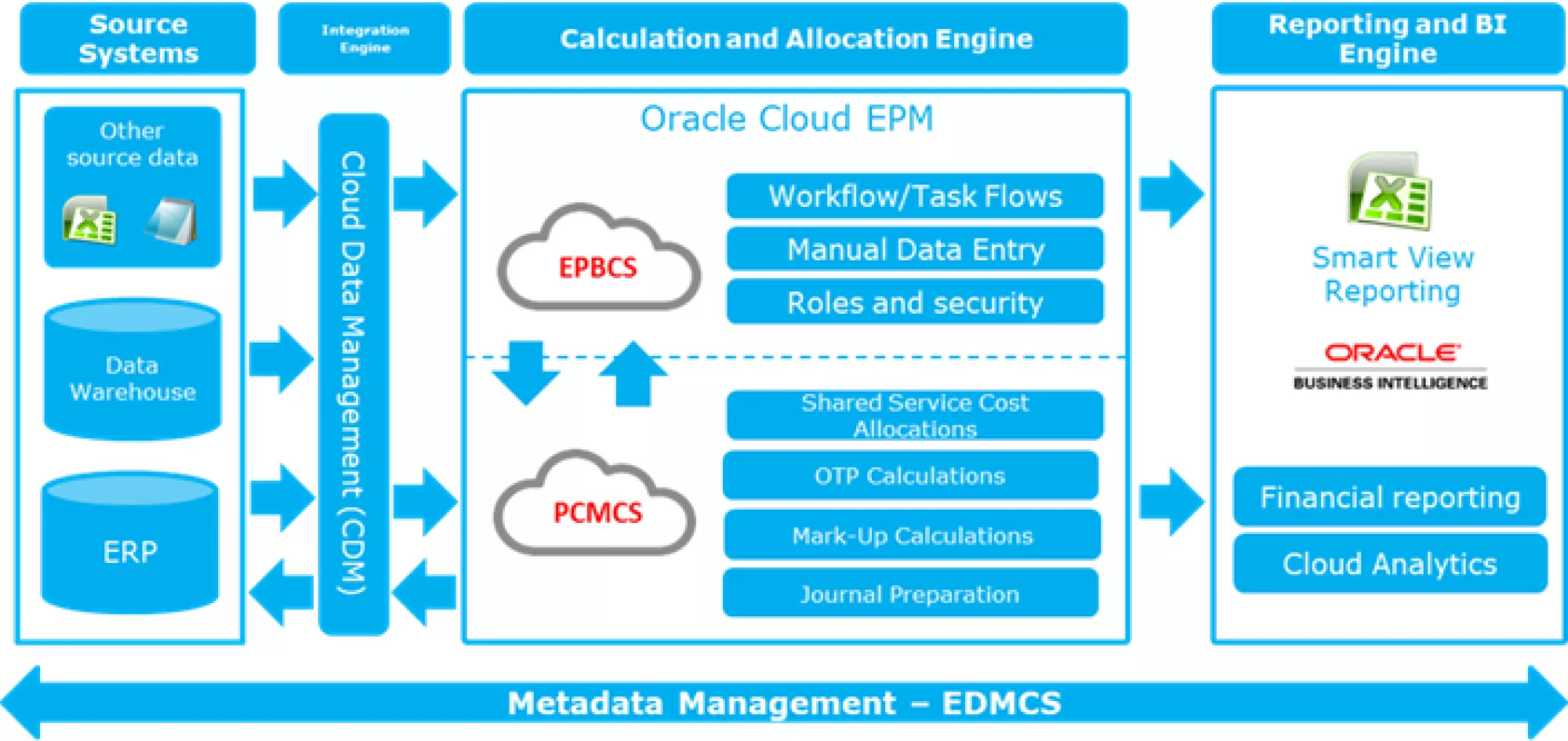

Although various application technologies are utilized in our solution and are all important elements of our OTP Cloud solution (e.g. Cloud Data Management (CDM), Oracle Enterprise Planning and Budgeting Cloud Service (EPBCS), and Enterprise Data Management Cloud Service (EDMCS), they are all supporting technologies to PCMCS. As such, it makes sense for us to set the foundation with PCMCS now and detail specific elements of the other technologies in later blog posts.

What is PCMCS and Why Should I Utilize it for OTP?

Alithya has a lot of great content on PCMCS as a technology, so I am not going to spend a lot of time detailing out why PCMCS should be selected as your profitability and/or costing tool in general terms. Instead, I am going to give a brief overview of PCMCS in specifically as it relates to OTP and explain why the technology forms such a core component of our OTP solution.

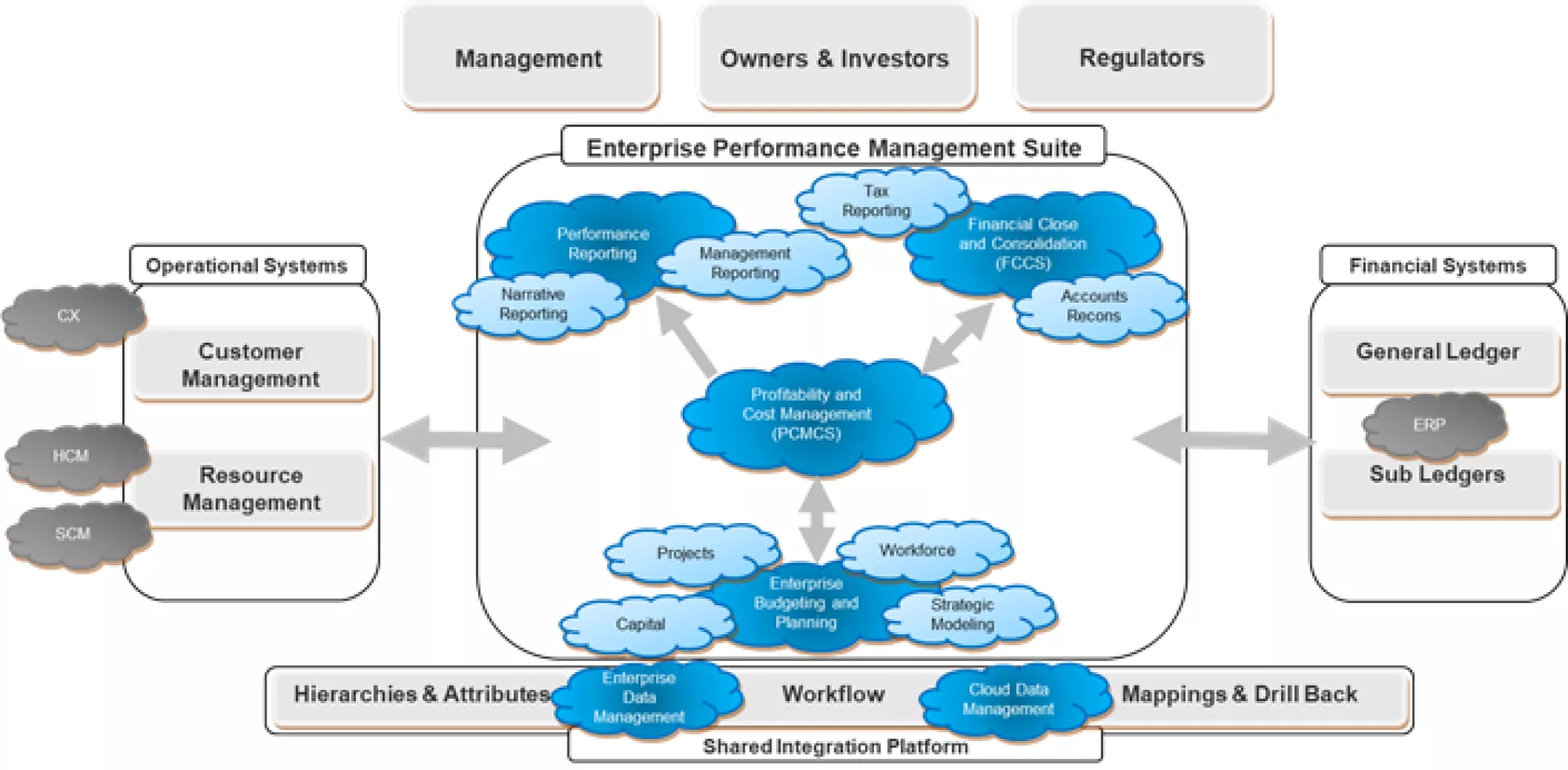

PCMCS is a robust calculation and reporting cloud solution that enables business users to gain control over the management of their calculation process, perform what-if analysis, and create stunning reports whilst providing unparalleled visibility and auditability. PCMCS can be utilized for a variety of business use cases such as Shared Services Costing, Expense Allocations, Operational Profitability, Intercompany Billing, and, of course, Operational Transfer Pricing.

PCMCS fits within the Oracle Enterprise Performance Management (EPM) suite of products and leverages the Essbase Database as the calculation engine for the technology. Because of this, PCMCS can be quickly and easily adopted in organizations that are already invested in the Oracle EPM suite in addition to having exceptional integration capabilities to the rest of the EPM suite.

PCMCS is so perfect for OTP because:

- It has the ability to accommodate all OTP methodology (more on this later) and trace the calculation of charges from source to the final recipient.

- It enables business users to take control of their OTP solution, making the solution scalable, flexible, and auditable through the use of a graphical rules engine with no prior coding knowledge required to learn or maintain the application.

- It provides enhanced reporting capabilities that enable business users to create and maintain critical reports without the intervention of IT.

- It offers the ability to integrate with source and target General Ledger applications and all Oracle EPM suite of products such as Financial Close Cloud Service (FCCS) and EPBCS. This is critical for both the collection of input data required by the OTP calculations and for the posting of calculated results in the General Ledger.

PCMCS is the perfect tool for OTP solutions; however, how we structure our models and calculations in PCMCS is ultimately the differentiator between success and failure.

Setting High Expectations

Before we can start building our OTP application, we first need to identify our expectations of the application itself. These expectations ultimately fall into two categories:

- Calculation Expectations

- These are expectations around the type of calculations that are performed within PCMCS and are largely dictated by the OTP methodologies that are utilized in the various transfer pricing catalogs.

- This blog will look into the calculation expectations in more detail.

- Reporting Expectations

- These are expectations that are derived from the consumers of the output of the OTP calculations. These consumers can be division heads who are required to know and understand their intercompany charges or auditors looking for inconsistencies in the OTP process.

- These expectations deserve their own attention and, as such, will have their own blog dedicated to them.

Although distinguishing between the above two expectations is important, they are closely intertwined with each other. The simplest example of this is that our reporting will not be accurate or meaningful if we are not executing the correct OTP calculations within PCMCS. The focus of this blog is on Calculation expectations, but various concepts that we introduce here will be leveraged in the related post that covers OTP Reporting.

OTP applications must, at a minimum, be able to produce calculated results through the modeling of various OTP Methodologies within the application. As such, to deliver OTP in our Oracle Cloud Solution, we must be able to model the various OTP methodologies in PCMCS. Below are some of the most common OTP methodologies that we see a requirement to support within our PCMCS applications:

- Price X Quantity-Based Methodologies:

- Market Rate:

- Market rate, or market base, involves the determination of a base rate derived from comparable normal market rates.

- A recipient of a service is charged based on the quantity of any given service multiplied by the rate of that service.

- Adjusted Market Rate:

- Similar to a market rate, an adjusted market rate involves the determination of a base rate derived from comparable normal rates but with an adjustment to accommodate company-specific differentiators.

- A recipient of a service is charged based on the quantity of any given service multiplied by the rate of that service.

- Negotiated Rate:

- A negotiated rate is a predetermined fixed rate for a rendering of a specific service that is agreed to by the provider and recipient of the service.

- A recipient of a service is charged based on the quantity of any given service multiplied by the rate of that service.

- Rates can be re-negotiated on a monthly, quarterly, semi-annual, and annual basis.

- Fixed Price Methodologies:

- Negotiated Fixed Price:

- Negotiated fixed price is fixed dollar values (for example, $10,000) charged in the rendering of a service to a recipient or recipients

- Prices can be renegotiated on a monthly, quarterly, semi-annual, and annual basis.

- Negotiated Fixed Percentage:

- Negotiated fixed percentage is an agreement that a fixed percentage of a pool of dollars (5% of $10,000) is charged to a recipient(s) for the rendering of a specific service(s).

- The pool of dollars is variable and subject to change, but the percentage of that pool that can be charged to the recipient(s) is not.

- Allocate Methodologies:

- Cost Contribution Arrangements:

- Cost contribution arrangements are agreements between various parts to share the cost of risks involved in the rendering of a service with the expectations that all recipients will enjoy the benefits of those services equitably.

- For these arrangements, a source pool of dollars is allocated to the recipient of the service based on a pre-determined driver basis. A mark-up can then be applied to the allocated base cost if applicable.

- Cost Plus:

- Cost plus is the most common OTP methodology implemented within PCMCS applications and involves the allocation of a pool of dollars that represents the cost in the rendering of a service to all applicable recipients on a defined driver basis. A mark-up is then applied to the allocated base cost.

- Cost Contribution Arrangements:

- Negotiated Fixed Price:

- Market Rate:

Workflow for Success

So now that we know what to expect from our PCMCS application, how do we start building? Well, before we start, let's look at the high-level workflow to build and maintain our OTP Solution:

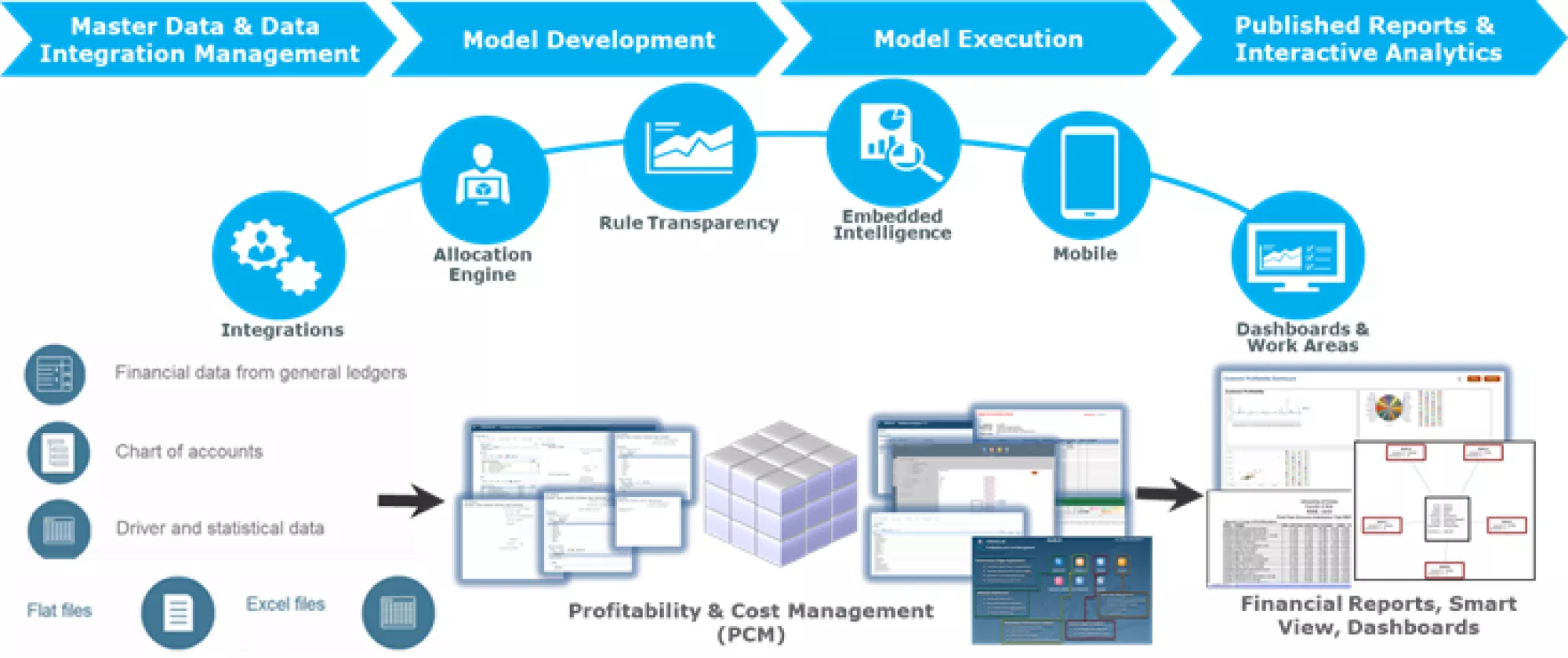

- Master Data and Data Integration:

- Development:

- This is arguably the most crucial phase in development where the master data (dimension outline) is developed and the required input data sourced

- The dimension outline of our PCMCS OTP application will determine the OTP methodologies that we can support and is also key in supporting the reporting output of our application.

- Enterprise Data Management Cloud Service (EDMCS) is introduced to simplify our metadata management, simplify our rule creation and maintenance, provide auditing capabilities, and ensure consistency with other EPM applications.

- Cloud Data Management (CDM) is introduced to simplify our data export process and enables the connection to multiple data sources, provides data transformation and mapping capabilities as well as process auditing capabilities.

- Enterprise Budgeting and Planning Cloud Service is introduced to provide advanced workflow and data input capabilities.

- Post-Go-Live:

- Post-go-live clients will source and maintain their metadata (dimensions) through EDMCS and source any required input data prior to loading to the solution.

- Development:

- Model Development:

- Development:

- During Development all of the various Rule Sets and Rules will be created to support the required OTP Methodologies required by the solution. Different Points of View (POV) can be developed for the various Scenario and/or Versions per client requirements.

- Post-Go-Live

- Rule Sets and Rules are maintained on a need to basis. The incorporation of EDMCS and the usage of various data flag techniques into the solution can significantly reduce the overhead required for the maintenance (more on this in an upcoming blog).

- Development:

- Model Execution:

- Development:

- During development, this is an interactive phase. As rule sets and Rules are developed, they are continually executed and tested. Unit test scripts are developed as part of development that can be leveraged later in the User Acceptance Testing phase of the implementation.

- Post-Go-Live:

- Users perform the relevant model validations and pre-allocated input checks.

- Users execute the required POV calculations.

- Users perform post allocated validations.

- Development:

- Publish Reports and Interactive Analysis:

- Development:

- Smartview Reports, Financial Reports, Invoices, and PCMCS analytics are developed to deliver on the OTP reporting expectations.

- CDM is configured to extract, transform, map, and load the post-calculated OTP output through journals to the destination general ledger applications.

- Post-Go-Live:

- Users refresh the various reports and disseminate them to relevant stakeholders.

- Execute the CDM load rules to extract, prepare, validate, and load the journals to the destination general ledgers.

- Development:

Additional posts in this blog series provide more insight into each of the application technologies (EDMCS, EPBCS, and CDM); this post clearly identifies the 3 key PCMCS elements for the next discussion:

- Defining the dimension outline.

- Defining the PCMCS rule sets and rules.

- Identifying and developing the OTP reports.

Conclusion

This post introduces the most core application technology of our Oracle Cloud OTP solution, PCMCS, and it shares the importance of PCMCS to our solution, identifies some of our key expectations, provides a deep dive into the types of OTP methodologies that the solution must be able to support, outlines the solution workflow, and identifies the key elements for related OTP posts in this series..

The next post in this series discusses the PCMCS dimension outline developed required to support our OTP solution and models the OTP methodologies in PCMCS using rule sets and rules.

For comments, questions, or suggestions for future topics, please reach out to us at [email protected]. Visit our blog regularly for new posts about Cloud updates and other Oracle Cloud Services such as Planning and Budgeting, Financial Consolidation, Account Reconciliation, and Enterprise Data Management. Follow Alithya on social media for the latest information about EPM, ERP, and Analytics solutions to meet your business needs.