The fixed asset data migration process from your legacy system to Microsoft Dynamics for Finance and Operations (D365FO), can at first seem a bit tricky and time consuming. For example, it requires: a data management job to import the fixed assets, journal entry to import the Acquisition values, journal entry for Accumulated Depreciation, and several data management import jobs to update the date fields after the journal entries have posted, so that the depreciation calculations are correct in D365FO. If you follow these instructions and depending on your knowledge of Data Management, you may need a little help from a technical resource. By following the process below you can have a successful data migration for Fixed assets. You may need to modify the steps below slightly for each client you have, as there are many different formats for legacy system Fixed Assets.

Fixed Asset Data Migration Process

The following steps will help ensure a successful (and uneventful!) data migration for fixed assets.

- Export your legacy system Fixed Assets static data and values for all fixed assets posting profiles into an excel file.

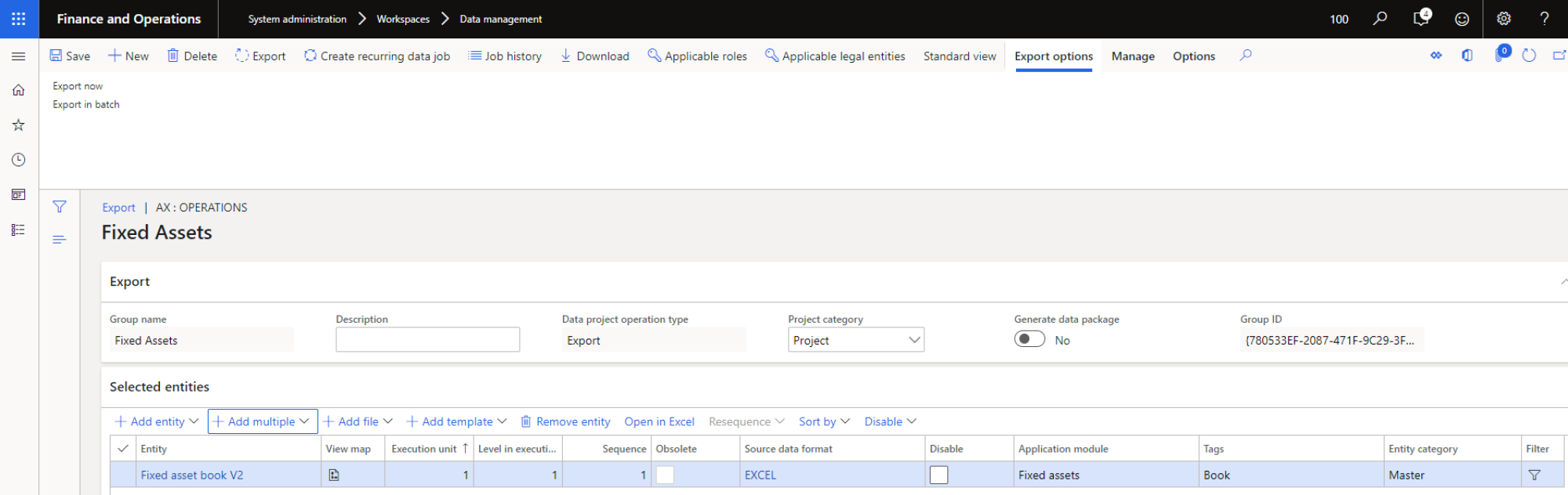

- Create a data management Export file for the data entity “Fixed asset book V2” and export it to Excel (you need a blank export file to add the data for the import file you will create later).

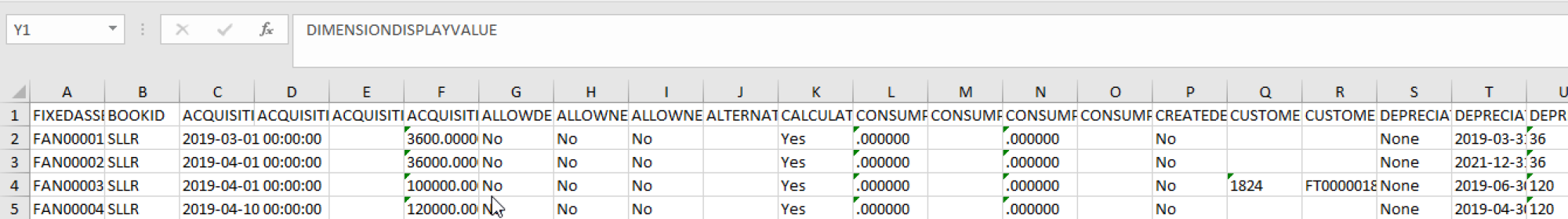

- Map your legacy system fields to the D365FO Fixed asset data entity fields and populate your data to the Excel file Fixed asset book V2.

- Using Data Management create an Import file in Excel to update the Fixed assets information to the entity Fixed asset book V2.

- Should include Deprecation periods remaining field value in months (may be weeks or days depending on the Company’s financial periods).

- Do not include the acquisition, deprecation or any other fixed assets posting type data. These will be imported using general journals.

- Post an acquisition general journal on the first day of the go live period. (i.e. Jan 1st 2021) – Debit with Description “Initial Load”

- Update the following fields on the Fixed asset book V2 data entity using the data management import job (IMPORTANT TO BE DONE BEFORE POSTING THE INITIAL DEPRECIATION ENTRY).

(Developer to write a script to do this.)- Acquisition date to the historical acquisition date.

- Placed in service date to historical placed in-service date - note that we will get a warning message that it is different from the acquisition date.

- Post the historical deprecation entry on the first day of the go live period. (i.e. Jan 1st, 2021) – Credit with Description “Initial Load” - Also over-ride the offset GL account assigned by the fixed asset posting profile to be the same as the CIP in progress account (will clear this out with the TB GL data load).

- Download the fixed asset sub ledger and confirm that the Net Book values reconcile to your legacy fixed asset system.

- IMPORTANT: Update the following fields. (developer script to do this or use Data Management)

- Date when depreciation was last run date to the last date of the period prior to the go live date.

- To validate that this data migration process worked.

- Run a deprecation proposal for the first month after the go live.

- Confirm the monthly deprecation reconciles to what you expected for each asset.

- Delete the proposal. Don’t post it as just using this to confirm the process worked!

- When loading the Trial Balance (Offset Fixed Assets Costs and Accumulated Amortization to the offset accounts used in steps 2 and 3.

- For any Assets that are not to depreciate – go into fixed asset and set the depreciation to no – this will prevent it from coming up during the depreciation proposal – in the event that it was missed, any lines in the depreciation proposal with zero dollars would need to be deleted before posting (otherwise will create an error message on posting, at which time the line would need to be deleted).

Like any process, this needs to be confirmed through extensive testing. If you have successful tests, then it puts you on the right path for a non-eventful data migration for fixed assets at Go live.