For many Insurers, there lies the issue of adequately associating the consumption of shared organizational or services costs across by what could be many operating affiliated companies and product lines. Though shared services are not new or unique to insurance companies, the industry’s complex organizational and legal structures offer additional challenges. While insurance companies may trade or report under a legally consolidated name, they may operate many affiliated companies that can be either wholly or partially owned. And even in the largest companies, this may include many small and specialized entities. In order for there to be efficiency in the consolidated enterprise, many common business and corporate functions can be and are centralized, including Underwriting, Risk Management, and Claims Processing, as well as the typical staff functions of Information Technology (IT), Human Resource (HR), Finance, Accounting, Treasury, Tax, Legal, and Facilities.

What has also emerged is that the largest operating company, at times the legacy founding company of the enterprise, has taken on the employment and management of the resources that perform these functions. It then bills these services out to internal consumers based on agreed-upon pricing arrangements or drivers, sometimes referred to as prorated consumption factors or prorates. These internal consumers need to report these costs at the legal entity and product level for the line of business reporting that appears in 10k, annual reports, and other official financial filings.

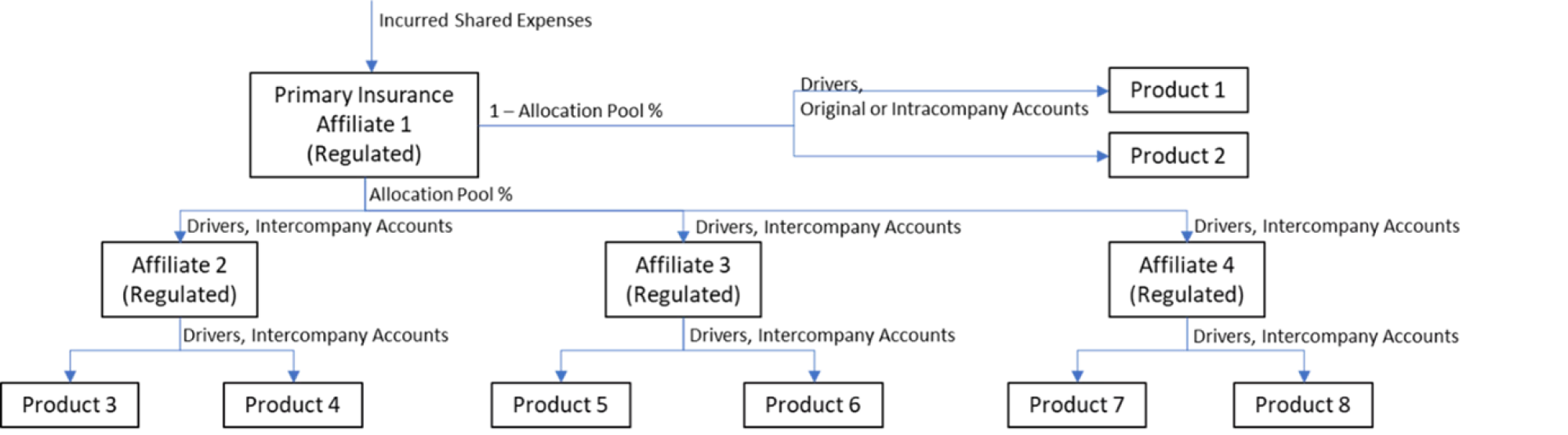

The challenge of flowing these costs through an insurance company business unit for billing to other affiliates is that an insurance company is itself a regulated body. This creates the need for more complexity in information gathering and reporting, and less flexibility to make changes based on business needs. It requires a careful capture of a factor that first determines how much of a given cost remains in the initial entity and how much is shared, followed by sequential driver-based allocations to other affiliates and then to product lines. Below is how such an arrangement may typically look:

Figure 1 - Shared Services with Insurance Affiliate as Service Provider

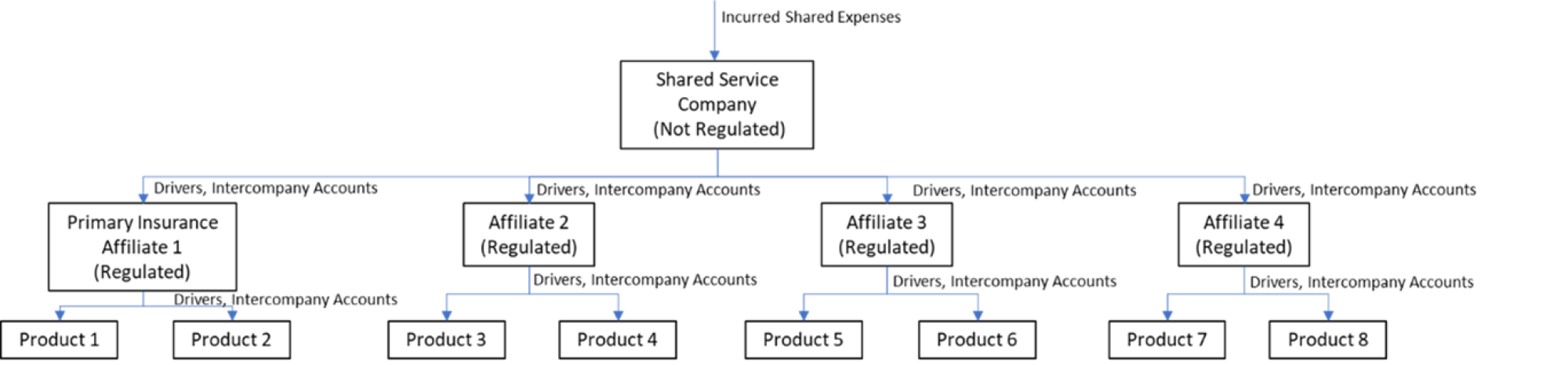

A more efficient and effective approach is to move the shared service-providing departments into a separate stand-alone entity that is not an insurance company, and create agreements for charge-outs with the operating affiliates. In other words, create an enterprise-shared facilities and services structure that is simpler and more adaptable to future organizational and regulatory changes.

The shared services company, not subject to the same insurer regulation, would therefore be more efficient to operate and more flexible to accommodate change. It would also reduce regulatory and audit risk and reduce complexity.

The new organizational structure would like the following, which is more streamlined:

Figure 2- Revised Shared Services Company Framework

Oracle EPCM offers a proven ability to perform allocations that are as elaborate as necessary, and accommodate insurers on a journey to setting up a unified shared services entity. Clearly, it is a journey because inter-company service agreements cannot be dropped, changed, or restructured overnight. As such, there would be a transition period to implement such a widespread organizational change. Details about capitalizing the new company, transferring assets, and setting up cash settlement processes are among the issues to be addressed, above and beyond the allocation bases and methods.

Alithya has been successful with multiple firms, helping them address this issue by leveraging the power of EPCM. With its sequenced flow, formula-based custom calculation rules to split costs into various pools of allocation, and its user-driven point-and-click allocation rules, EPCM can achieve this undertaking.

In one example, a major insurer was able to build a PCM application that simultaneously replaced a legacy Oracle Standard Profitability application and incorporated a new centralized shared services organizational structure. The PCM application was designed to be flexible, such that the transition from an insurer business unit that was handling and billing out services to a central company doing so, would be data-driven without having to modify rule logic. As functions transition to being administered by the new company, the data drives which rules to use. While the new framework simplified the allocations process and supported the highly advantageous shared services company business model, the system still needed to handle complexities that remained. Such examples were BU and Affiliate capture on each allocation to support journal entries, and to have the allocations to both entities and products use special accounts designated for inter-company affiliated trading. All of this is achievable with EPCM.

Additionally, by removing the cost pool splitting required in the insurer-to-insurer based allocation process, there may be an opportunity to eliminate the entity-to-entity step and go straight to entity and product combinations with a single driver and set of rules.

In conclusion, insurers can derive benefits from the efficiency of centralizing shared support service costs into a separate consolidated entity. While this benefit is common across almost all industries, insurers have the opportunity for an even more significant incremental benefit by taking such resources out of regulated insurance entities and placing them into a non-regulated services company. While the process of creating this organizational framework has its up-front costs in capitalizing, asset transfer, service agreements, vendor agreements, and payroll/HR considerations; its flexibility and reduced complexity make a strong business case for it. Oracle EPCM becomes part of the process to enable this organizational benefit by affecting the actual transfers of dollars between the entities, once the organization is established, and it does so in a way that is transparent and adaptable to change.

For comments, questions, or suggestions for future topics, please reach out to us at [email protected]. Visit our blog regularly for new posts about Cloud updates and other Oracle Cloud Services such as Planning and Budgeting, Financial Consolidation, Account Reconciliation, and Enterprise Data Management. Follow Alithya on social media for the latest information about EPM, ERP, HCM, and Analytics solutions to meet your business needs.