Oracle recently released a new solution called “Predictive Cash Forecasting” to meet Treasury Departments’ needs for short and medium-term cash forecasting. As an implementer who has had to cobble together cash forecasting solutions for clients using Strategic Modeling and custom applications using EPM Cloud Planning, this is an absolute game changer. Predictive Cash Forecasting (PCF) provides pre-built content specifically designed to solve business challenges associated with near-term cash forecasting.

The list of pre-built content and features in Predictive Cash Forecasting is extensive, so for now I have boiled it down to my view of the Top 5 features of Predictive Cash Forecasting:

1. Usage of Predictive Analytics, Insights, and Machine Learning

As its name suggests, Predictive Cash Forecasting is laden with AI/ML and Predictive Analytic capabilities. With the specific timing of cash receipts and disbursements playing such a key role in the accuracy of short-term cash forecasts, it is imperative that any solution in this space leverages computer generated predictions on timing to improve the accuracy of the cash forecast process. To this end, Oracle has provided a trio of Intelligent Performance Management (IPM) capabilities in PCF:

Predictive Analytics can be deployed to predict forecasted values for specific cash receipts or disbursements using a whole host of statistical algorithms. Many of these algorithms detect seasonality in historical data and utilize those seasonal trends to guide its predictions. Predictive Analytics can also be done at a summary bank balance level to corroborate the bottoms up forecast done at the line item level.

Insights are part of Oracle’s IPM capabilities that auto-generate and surface problems and/or opportunities that it finds with the results of the Cash Forecasting process. The auto-generation of these insights frees up significant time for the Treasury team that would otherwise be spent trying to uncover these issues. Insights fall into the following categories:

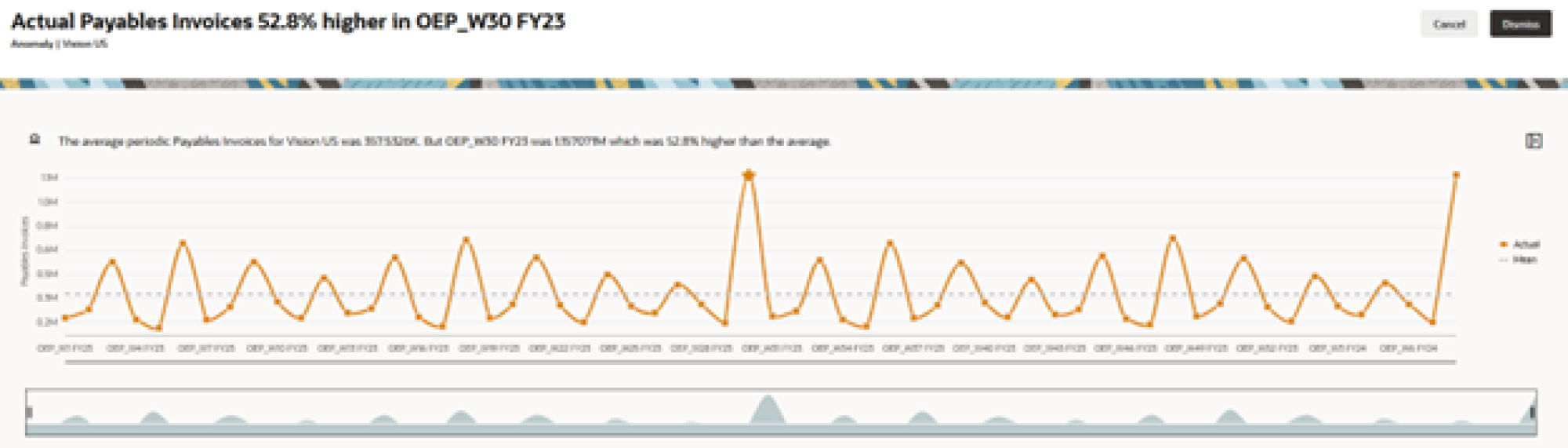

- Anomalies – an anomaly is something that deviates from what is normal or expected. In Cash Forecasting, this may be a significantly higher than usual capital expenditure, tax payment, or other use or source of cash. By automatically surfacing anomalies, users can quickly address whether the anomaly was a one-time event that should be ignored when forecasting or an indication of a new pattern that should be factored into the forecast process

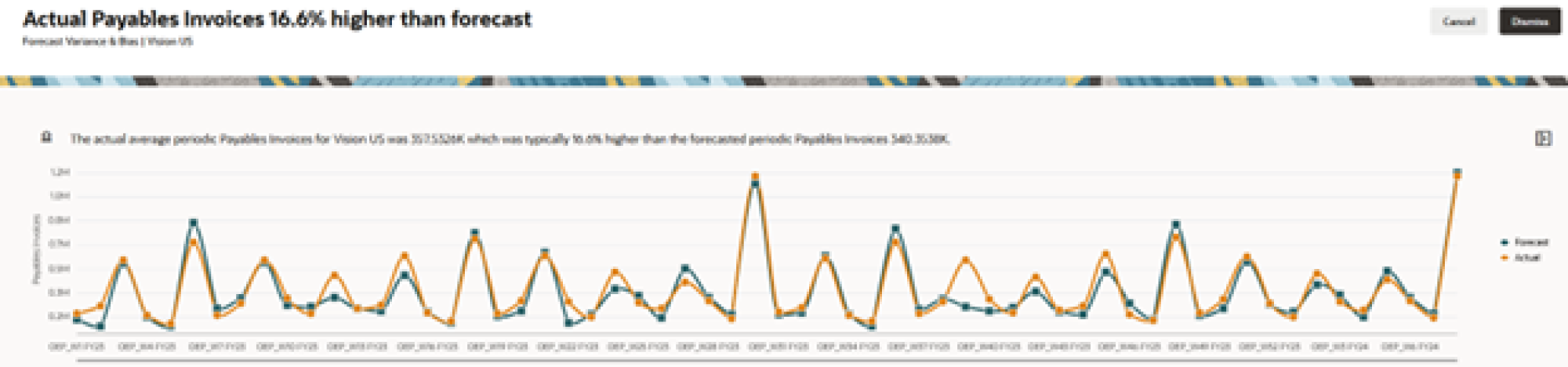

- Forecast Variance and Bias – this Insight compares forecast to actuals to detect if there are forecast accuracy issues or habitual biases in the way cash flow line items are being forecast. In the example below, it shows us that the forecast for Payables was on average understating the actual expense by nearly 17%.

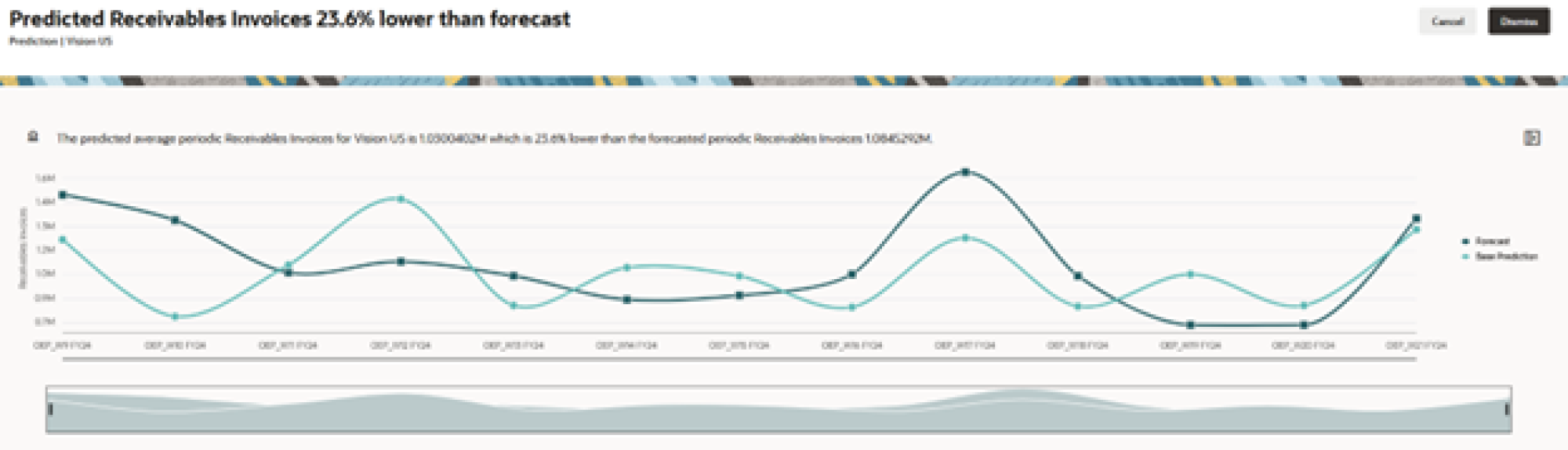

- Prediction Insights – these are insights into material differences between the value provided from a naïve forecast (driver-based or trend) vs. the value forecasted by a prediction (statistical prediction or ML prediction). If the results are significantly different between these two methods, a Prediction Insight will be generated. Users can then decide if they want to utilize the predicted value instead of the naïve forecast method.

Machine Learning (ML) algorithms can be applied to customer transactional details to predict the most likely payment date of individual invoices thanks to the coming integration between Oracle Cloud ERP and Predictive Cash Forecasting. ML models can be trained on various attributes of a transaction including the order fulfillment source, underlying sales details, payment terms, currency, historical customer payment patterns, etc. This allows for a much more accurate prediction on the timing of cash receipts, which is a huge component of a cash flow forecast. Note that this feature is expected to be released in the second half of 2024.

2. Ability to independently forecast at the Daily and Weekly level of period detail

This is an important and unique feature of PCF because some companies do a daily cash forecast, others do a weekly or monthly cash forecast, and some companies do both. Oracle provides the flexibility to do all of the above by providing separate Plan Types with unique Period dimensionality pre-configured. The benefit of this is that it allows customers to plan at the daily level of detail for the near term (say for the next 15 to 60 days) and then utilize a weekly or monthly level of detail for the intermediate term (for example, next 13 weeks or next 6 months). Daily and Weekly forecasts can then be easily brought together for consolidated reporting in a provided ASO Reporting Cube.

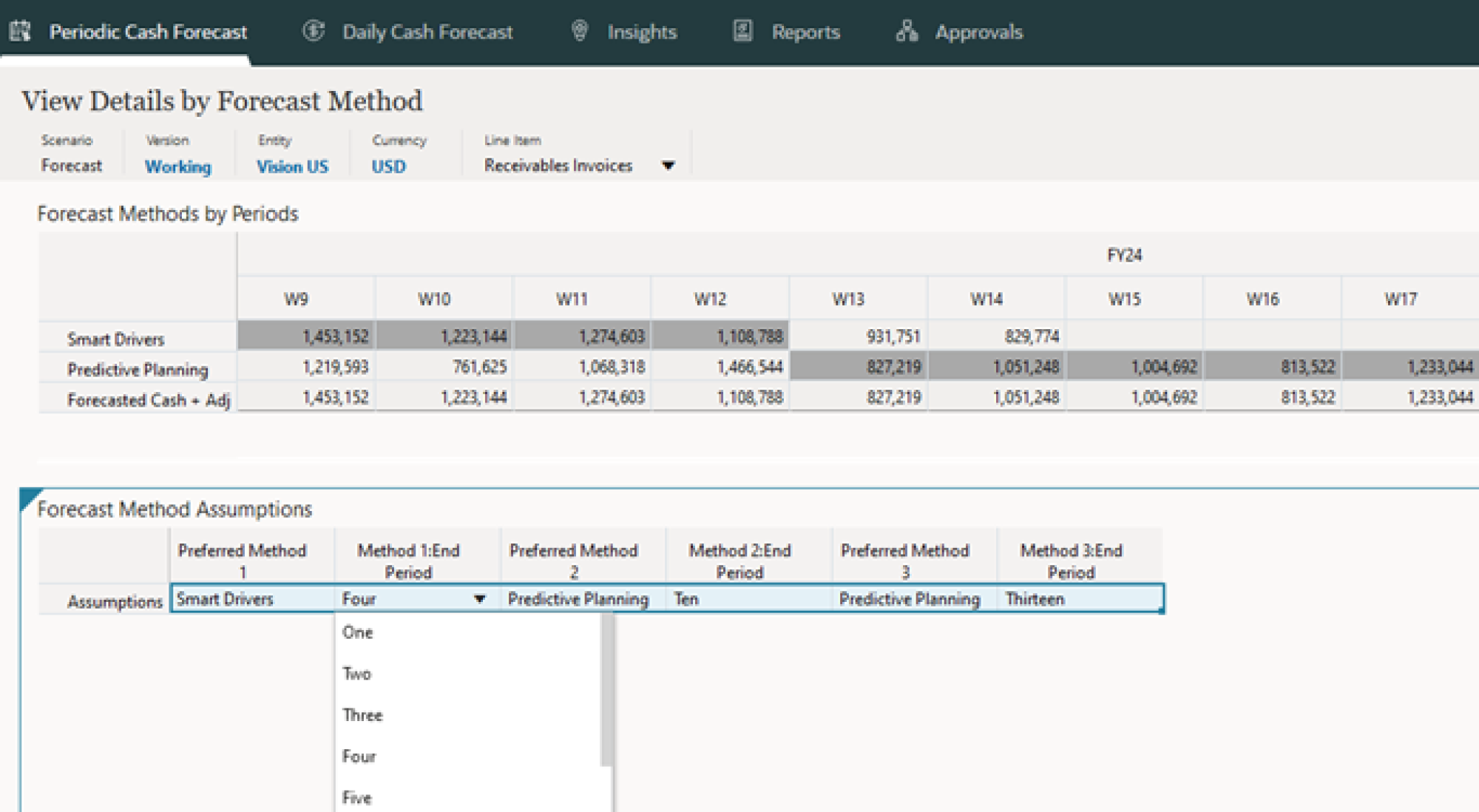

3. Concept of Forecast Methods by Period Ranges

One of the key challenges of doing a cash forecast is that the method that may be most accurate for one period range (say the next 30 days) is not accurate enough to be used beyond that initial timeframe. That is because for certain line items you have immediate line of sight into the timing, but beyond a certain timeframe, that no longer holds true. As an example, a company whose standard payment terms are Net 30 Days knows what invoices have been issued in the past 30 days and, based on history, can make predictions on when those invoices will be paid in the coming month. However, when trying to forecast beyond 30 days, they would no longer have insight into individual invoices and therefore forecasting using Smart Drivers may lead to inaccuracies. They might find that using a driver-based approach or other forecast method works better for periods beyond the initial 30 days. Oracle neatly solves this problem by providing the concept of Forecast Methods by Period Ranges. A user can simply select from a dropdown box the method to be used and the associated time range. This allows the user to establish multiple forecast methods for multiple time ranges for each item that they are forecasting without needing to resort to complex business rules with conditional logic.

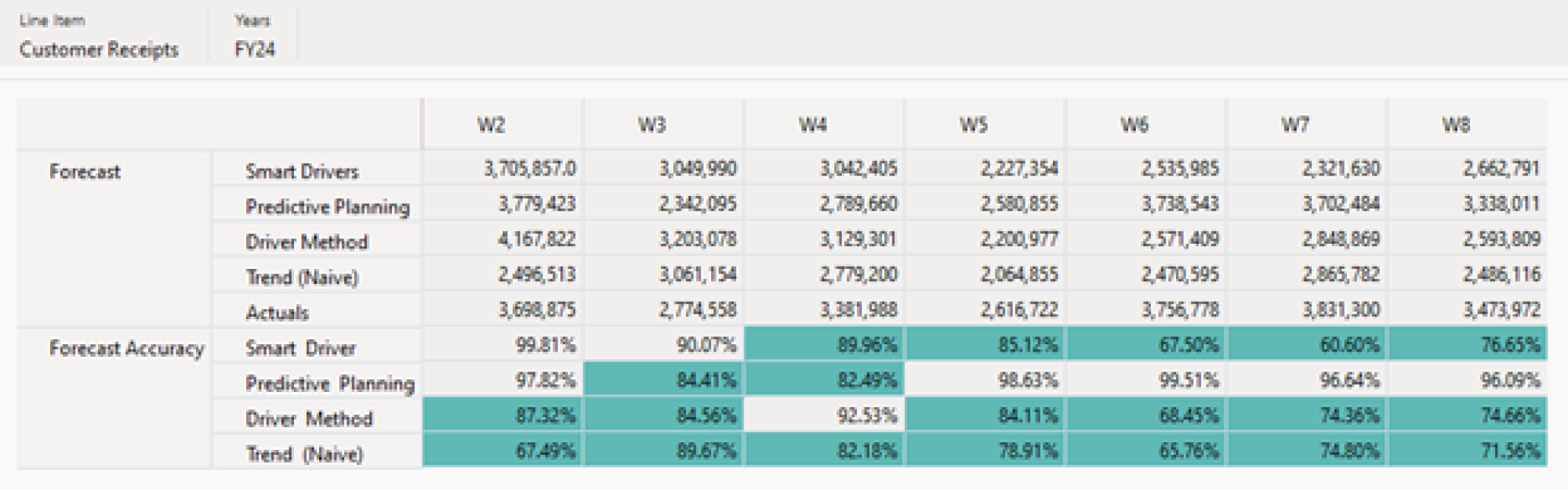

4. Forecast accuracy analysis with Forecast Value Add

With so many forecasting options available out-of-the-box with PCF, the relevant question becomes which forecast method is the most accurate in predicting sources and uses of cash. To solve this question, Oracle delivers the concept of Forecast Value Add (FVA) which provides users with a dashboard displaying the accuracy of Trends, Driver-Based, Predictive Planning, and Smart Driver forecasting approaches against recent actuals. Results can be averaged and bucketed between various time horizons as the accuracy of an approach may be good in the short term but inferior to other approaches in the medium and long term. This concept can and should work hand in hand with the previous concept of setting Forecast Methods by Period Ranges to optimize the accuracy of your cash forecast for all time period ranges.

5. Plethora of pre-packaged planning product properties

Oracle’s in-depth understanding of the cash flow forecasting business process has led to the thoughtful build out of pre-packaged content to meet the specific business requirements for that process. This pre-built content allows companies to jump start their adoption of Predictive Cash Forecasting and significantly lessen their time-to-value. PCF provides the following pre-packaged artifacts:

- Pre-seeded Forecast Methods

- Machine Learning Predictions

- Smart Drivers

- Statistical Predictions

- Driver Based

- Trend Based

- Manual

- Pre-seeded Dimensional Model – In addition to the standard dimensions available in all Planning applications, Oracle provides the following PCF specific dimensions to facilitate the Cash Forecasting process:

- Bank – ability to analyze cash by different bank and bank accounts

- Forecast Method – ability to forecast using multiple forecast methods and pick the most accurate one

- Party – ability to source and forecast by Customer and Suppliers

- Currency – ability to forecast by multiple local currencies

- Business Unit – this allows for cash forecasting and reporting by business unit or division of a company

- Category – generic placeholder dimension that can be used to segment data by Project, Asset, etc.

- Pre-seeded Line Items and KPI’s – accounts or line items typically used in producing a cash forecast have been pre-seeded along with KPI’s and associated calculations

- Pre-seeded Forms – over 30 pre-built Forms to facilitate both Daily and Weekly Cash Forecasting processes

- Reports and dashboards – PCF provides a number of pre-built reports and dashboards for both Daily and Weekly Cash Forecasting processes as well as pre-configured Data Maps to push to an ASO reporting cube for consolidated reporting

- Business rules – pre-built business rules have been created for both Daily and Weekly Cash Forecasting to perform currency translation logic, create what-if scenarios, clear data, etc.

- Pre-seeded Navigation Flows to guide individual roles (i.e. Cash Manager, Controller, Admin) through the Cash Forecasting process with content specific to each role

Upon enabling PCF, organizations will immediately have access to all of this great content from day one. Additionally, users have the capability to further configure the solution to extend its capabilities to meet company-specific business requirements.

While these five features are impressive, there is more to come as Oracle is planning a 2nd major release of Predictive Cash Forecasting in the 2nd half of 2024 which will provide direct integration with Cloud ERP, unlocking the following incremental capabilities: Drill through to Cloud ERP, Smart Drivers based on Invoice Due Dates, and Machine Learning Predictions using invoice level transactional data. Stay Tuned.

About Oracle Predictive Cash Forecasting

Predictive cash forecasting is a solution within Oracle Cloud Applications that allows treasury and finance to automate cash management and forecasting in real time, while continuously predicting future liquidity using machine learning. The solution automates all relevant data streams to reduce manual effort and empowers all stakeholders to collaborate toward the optimization of cash. The solution includes automated insights and dashboards to keep stakeholders up to date and aligned on the most recent developments in cash. Machine learning on transactional details improves accuracy and speed while also uncovering hidden patterns and key drivers of working capital. Users go from insight to action with the ability to effectively manage cash surplus, mitigate cash shortfalls, and better manage banking relationships.